what is suta tax rate for california

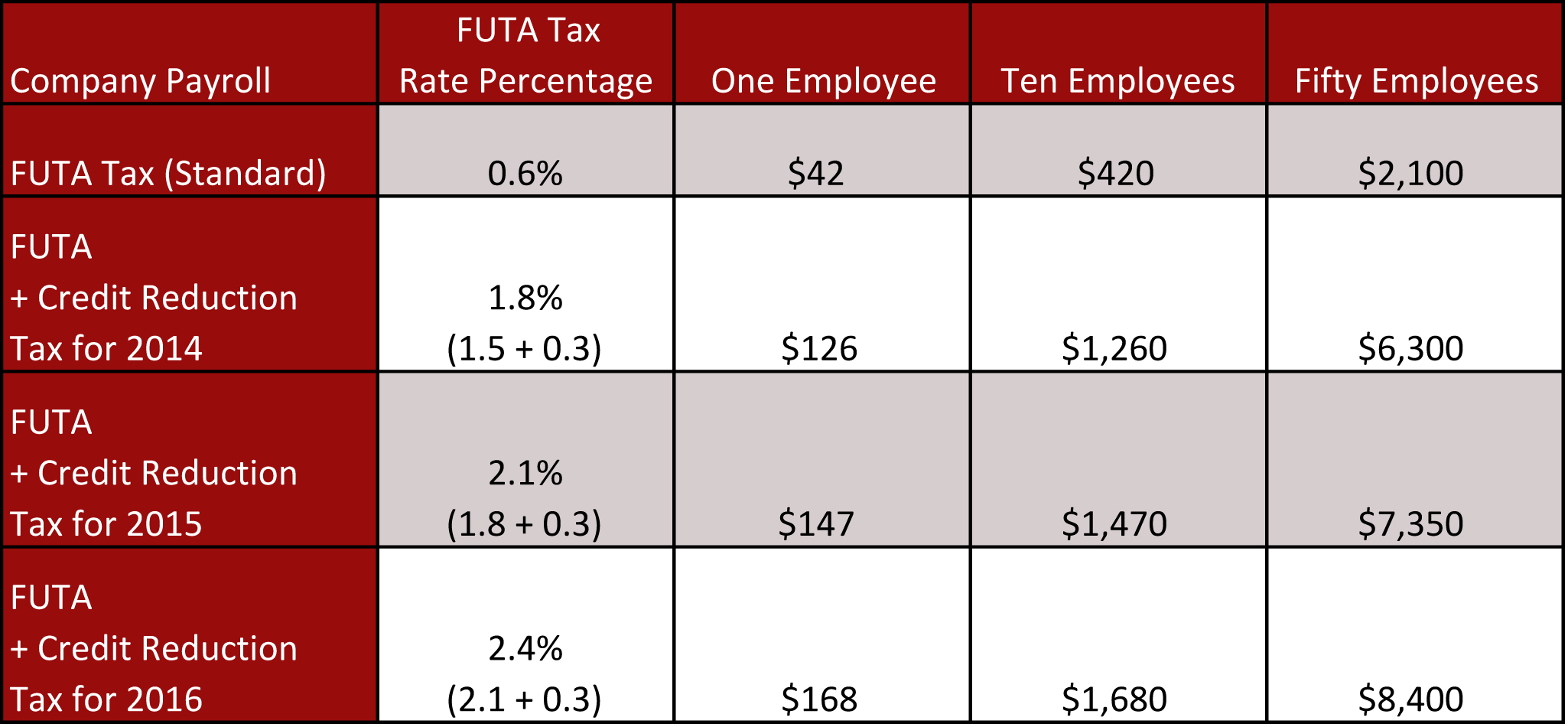

This year FUTA tax rates are 6 percent as per the FUTA tax rates. Employers in California are subject to a SUTA rate between 15 and 62.

Employers will receive an assessment or tax rate for which they have to pay.

. Employers pay up to 62 on the first 7000 in wages paid to each employee in a calendar year. You will pay 1050 in SUI. Here is how to do your calculation.

The ETT taxable wage limit is 7000 per employee per calendar year. The UI rate schedule and amount of taxable wages are determined annually. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees.

Imagine you own a California business thats been operating for 25 years. Your state will assign you a rate within this range. Current federal law provides employers with a 54 percent FUTA tax credit and no FUTA tax credit reduction will occur in 2022 for wages paid to their workers in 2021.

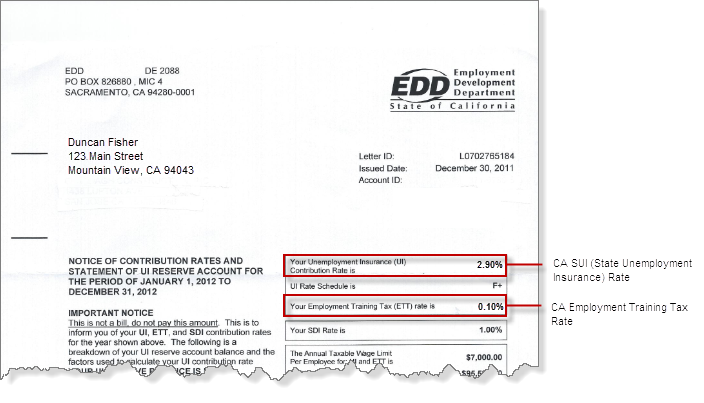

Using the formula below you would be required to pay 1458 into your states unemployment fund. The ETT rate for 2022 is. The 2020 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

SUTA dumping is also referred to as state unemployment tax avoidance and tax rate manipulation. 52 rows Most states send employers a new SUTA tax rate each year. 52 rows The tax rates are updated periodically and might increase for businesses in certain industries that have higher rates of turnover.

What Is The Current Suta Rate For 2020. Like SUTA wage bases SUTA rates also vary state to state. Each state typically has a range of SUTA rates eg 065 68 in Alabama.

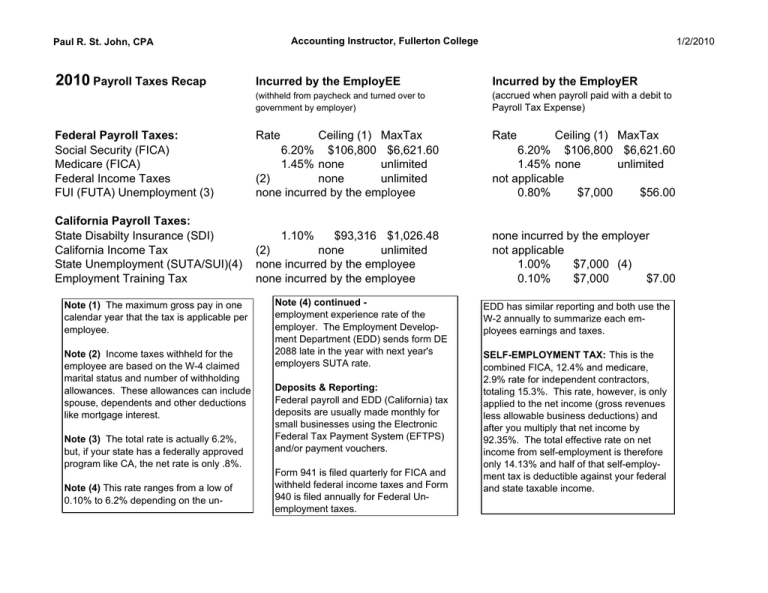

The new employer SUI tax rate remains at 34 for 2021. The tax rate for new employers is 17. The tax rate for new employers is to be 34.

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. SUTA dumping is also referred to as state unemployment tax avoidance and tax rate manipulation. 1 2021 unemployment tax rates for experienced employers are to be determined with Schedule F and are to range from 15 to 62.

The SDI withholding rate is the same for all employees and is calculated annually. During the year you paid each employee at least 7000 in wages. The new employer SUI tax rate remains at 34 for 2020.

For 2022 as in 2021 unemployment tax rates for experienced employers are to be determined with Schedule F and are to range from 15 to 62. Generally states have a range of unemployment tax rates for established employers. To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate.

In California in recent years it has been somewhere around 34. Employers in California will pay no higher than 1 percent of their payroll as SUI taxes for 2020. Additionally positive-rated employers and new employers are to be assessed an employment training tax of 01 for 2021 unchanged from.

2020 SUI tax rates and taxable wage base. California does have an outstanding loan balance as of January 1 2021 so future credit reductions are. For example the SUTA tax rates in.

The SDI withholding rate for 2022 is 110 percent. The EDD notifies employers of their new rate each December. A new employers rate usually will remain the same for at least the first two or three years.

You cannot protest an SDI rate. The tax rate for new employers is to be 34. The taxable wage limit is 145600 for each employee per calendar year.

The maximum amount of taxable wages per employee per calendar year is set by statute and is currently. The maximum tax is 434 per employee per year calculated at the highest UI tax rate of 62 percent x 7000. See more information here.

The SUI taxable wage base for 2020 remains at 7000 per employee. When you register as an employer your state will generally tell you what your SUTA tax rate is. The SDI withholding rate for 2022 is 110 percent.

In 2018 the trust fund regained a positive balance after nine years of insolvency. When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the account with the lower rate. 20 rows California.

As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to include a 15 surcharge. Tax rates for the second quarter range from 01 to 17 for positive-rated employers and from 33 to 75 for negative-rated employers. The taxable wage limit is 145600 for each employee per calendar year.

For past tax rates and taxable wage limits refer to Tax Rates Wage Limits and Value of Meals and Lodging DE 3395 PDF or visit Historical Information. Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27. What is California tax rate for payroll.

New Hampshire has raised its unemployment tax rates for the second quarter of 2020. For example the wage base limit in California is 7000. The ETT rate for 2022 is 01 percent.

The maximum to withhold for each employee is 160160. The entity with the higher rate is then dumped Such abusive schemes leave other employers making up for the unpaid tax. New employers pay 34 for the first two to three yearsCalifornia State Payroll Taxes.

Many states give new employers a standard new employer SUTA rate. The new employer SUI tax rate remains at 34 for 2020. Each state has a range of SUTA tax rates ranging from 065 to 68.

SUTA tax rates will vary for each state. New employers pay 34 percent 034 for a period of two to three years. 350 x 3 1050.

5 of 7000 350. The UI rate schedule and amount of taxable wages are determined annually. Established employers are subject to a lower or higher rate than new employers depending on an experience rating.

An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes. Once you know these you can do the calculation. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

1 2022 the unemployment-taxable wage base is to be 7000 the department said on its website. Employees of the SUI will receive a 73 tax rate for 2020 based on the taxable wage base.

How To Update Suta And Ett Rates For California Edd In Qbo Youtube

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop Youtube

A Complete Part 2 Of Form 940 Based On The Following Information Round Your Answers To Homeworklib

2010 Payroll Taxes Recap Incurred By The Employee Incurred By The Employer

Suta Dumping And Unemployment Insurance Rate Manipulation

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

Futa Federal Unemployment Tax Act San Francisco California

The True Cost Of Hiring An Employee In California Hiring True Cost California

What Is Sui State Unemployment Insurance Tax Ask Gusto

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Suta Tax Your Questions Answered Bench Accounting

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer

What Is Sui State Unemployment Insurance Tax Ask Gusto

Does Quickbooks Automatically Adjust Employer Payroll Tax Rates At The Beginning Of A New Year Newqbo Com

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor